THE NEW REPUBLIC

August 12, 2010

Speaking at a health care reform rally in Raleigh, North Carolina, in July 2009, President Obama declared that the worst of the recession was over. “We have stopped the free-fall. The market is up and the financial system is no longer on the verge of collapse,” he said proudly.

A year or so later, with midterm elections looming and an electorate that is as fearful and angry as any in memory, the stock market has risen, but even a breath of bad news can send it tumbling. As dismal as housing prices continue to be, they have yet to hit bottom in some places. Unemployment remains frozen at an overall level of nine-plus percent, and job creation has been anemic. If the crisis belonged to George W. Bush, the recovery has been Obama’s—and it has been a fragile and tentative one at best. Along with billions of dollars in stimulus payments, the president has spent down most of his political capital. So what is his next step?

That depends upon how serious Obama is about his legacy—whether he is looking to win votes for himself and his party in the short-term, or to lay the foundation for a durable new economic and social order that is only beginning to emerge but is required for sustained prosperity. The two goals are not mutually exclusive, but neither are they always compatible.

Let me say first that the bailouts and stimulus programs of the last two years were not a complete mistake. Economic policymakers don’t have the luxury of hindsight in the heat of a crisis; there is tremendous pressure on them to do something. It would have been suicidal not to give the banks the capital infusions they needed when the whole financial system was on the brink of meltdown or to refuse to help states avoid laying off thousands of teachers and police and other workers.

But now we find ourselves having the wrong debate—about whether a stimulus is needed or not—and we need to shift it. The fiscal and monetary fixes that have helped mature industrial economies like the United States get back on their feet since the Great Depression are not going to make the difference this time. Mortgage interest tax credits and massive highway investments are artifacts of our outmoded industrial age; in fact, our whole housing-auto complex is superannuated. As University of Chicago economist Raghuram Rajan wrote recently in the Financial Times: “The bottom line in the current jobless recovery suggests the US has to take deep structural reforms to improve its supply side. The quality of its financial sector, its physical infrastructure, as well as its human capital, all need serious economic and politically difficult upgrades.” Now we’re getting to the nub of the matter.

§

Why? Because this is no bump in the business cycle that we are going through; it is an epochal event, comparable in magnitude and scope to the Great Depression of the 1930s, and even more so, as historian Scott Reynolds Nelson has observed, to the decades-long crisis that began in 1873. Back then our economy was undergoing a fundamental shift from agriculture to industry. We are in the midst of an equally tectonic transition today, as our industrial economy gives way to a post-industrial knowledge economy—but by focusing all our attention of whether we need a bigger stimulus or a smaller deficit, we’re flying blind.

These kind of epochal changes, which I have called “great resets,” are long, generational processes. They are driven by improvements in efficiency and productivity, and by the waves of innovation that Joseph Schumpeter called “creative destruction.” When economies slow down, inefficient companies go by the boards. Seeking better returns on investment, businesses redirect capital towards innovation. When the economist Alfred Kleinknecht diagrammed U.S. patents along a timeline extending through the nineteenth century, he found a huge spike in the 1870s, 1880s, and 1890s, a period of depression that also saw the invention of electric power, modern telephony, and street and cable car systems. The economic historian Alexander Field observed a similar clustering and unleashing of innovation in the 1930s, which he dubbed the most “technologically progressive decade” of the twentieth century. More R&D labs opened in the first four years of the Great Depression than in the entire preceding decade, 73 compared to 66. By 1940, the number of people employed in R&D had quadrupled, increasing from fewer than 7,000 in 1929 to nearly 28,000 by 1940, according to the detailed historical research of David Mowery and Nathan Rosenberg.

Our transition from a Fordist mass production economy, based on the assembly line, to a knowledge economy, in which the driving force is creativity and technological innovation, has been under way for some time; the evidence can be seen in the physical decline of the old manufacturing cities and the boom in high-tech centers like Silicon Valley, government boomtowns like Washington DC, and college towns from Boulder to Ann Arbor. Between 1980 and 2006, the U.S. economy added some 20 million new jobs in its creative, professional, and knowledge sectors. Even today, unemployment in this sector of the economy has remained relatively low, and according to Bureau of Labor Statistics projections, is likely to add another seven million jobs in the next decade. By contrast, the manufacturing sector added only one million jobs from 1980 to 2006, and, according to the BLS, will lose 1.2 million by 2020.

This is the future towards which our post-industrial economy is already trending—and government should be proposing policies that will help to create a new geography and a new way of life to sustain and support it. But that doesn’t mean we need a centralized public bureaucracy to speed the process of change. As it happens, innovation occurs not only within big companies, major laboratories, and research universities, but also on the margins of business and academia. John Seely Brown, the former director of Xerox’s storied Palo Alto Research Center (PARC), has observed that many, if not most, of today’s high-tech innovations are products of the open-ended, collaborative explorations of hackers. Steve Jobs didn’t invent the PC; he saw its components at work at PARC, realized their potential, and put the pieces together.

§

Silicon Valley attracted the smartest innovators and entrepreneurs and provided them with the freedom and the funding to mobilize the resources they needed to start their own companies. What worked in Silicon Valley has to be reproduced across the board—government and business need to work together to create and maintain an open environment for innovation. That means dialing back intellectual property restrictions to encourage a freer flow of ideas; encouraging universities to open up their labs and discoveries to the world; and actively enabling and attracting entrepreneurs (a resource that is in truly short supply) from all over the world to come to the U.S. and turn new discoveries into companies that can grow and create jobs. We have to encourage our own young people to take risks and start companies, too. That means providing portable benefits, and not just in health care.

Our whole education system needs a drastic overhaul to make its teaching styles less rote and more dynamic, to encourage more hands-on, interactive creativity. The centralized school system as we know it is, after all, another product of the Industrial Age. And we shouldn’t fret about having to teach non-native students the English language either. An uninterrupted inflow of talented immigrants is absolutely key to our future prosperity.

Entrepreneurship should become the fourth R, right alongside reading, writing, and arithmetic. Kids need to learn more than just the abstract principles of economics—they should be taught how to form businesses, create business plans, and market their ideas. Education can no longer be confined to traditional academic subjects; students must learn how to create something of their own. Imagine if we devoted a fraction of the time and money and passion that we give to athletics to helping our young people learn how to turn their ideas into enterprises. We are wasting time and resources training young people for factory and administrative jobs that no longer exist; they have to learn how to innovate and create jobs of their own.

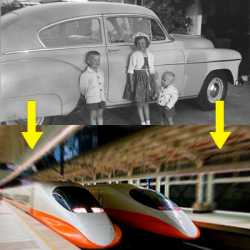

That brings me to a central issue that has been completely absent from the current debate. As our new economy emerges, a new way of life and a new geography of living and working must come into being as well. We didn’t finally emerge from the Great Depression until the rise of the suburbs in the 1950s, which fuelled demand not just for single-family homes but for the cars, refrigerators, washer-driers, TVs, and stereo systems that were coming off the assembly lines. Home ownership provided a powerful form of geographic Keynsianism.

§

But that system has reached the end of its useful life. It has led to overinvestment in housing, autos, and energy and contributed to the crises we are trying so hard to extricate ourselves from today. It’s also no longer an engine of economic growth. With the rise of a globalized economy, many if not most of the products that filled those suburban homes are made abroad. Home ownership worked well for a nation whose workers had secure, long-term jobs. But now it impedes the flexibility of a labor market that requires people to move around. My own research shows that the most innovative, most productive, and most highly skilled regions have rates of homeownership of 55-to-60 percent, while those where homeownership exceeds 75 or 80 percent are economically distressed.

Federal policy needs to encourage less home ownership and a greater density of development, along with the construction of smaller and more low-energy houses—not just because this is a greener way of life (which it is), but because it’s required to free up capital that can be invested in the skill development, technology development, and economic structures that the economy of the future requires. That means eliminating the mortgage interest tax deduction along with other massive federal subsidies for the secondary mortgage market, as well as other massive subsidies for road construction and infrastructure that undergird sprawling, economically inefficient, utterly wasteful suburban and exurban development. I am not advocating that we become a nation of renters, but the balance of homeownership should tilt back from its current level of 66 percent to perhaps 60 or even 55 percent.

Instead of further encouraging the growth of an auto-housing-suburban complex, the government should promote those forces that are subtly causing the shift away from it. Chief among these are the creation of inter-connected mega-regions, like the Boston-Washington corridor and the Char-lanta region (Atlanta, Charlotte, and Raleigh Durham) and ten or so more across the United States. Concentration and clustering are the underlying motor forces of real economic development. As Jane Jacobs identified and the Nobel Prize-winning economist Robert Lucas later formalized, clustering speeds the transmission of new ideas, increases the underlying productivity of people and firms, and generates the diversity required for new ideas to fertilize and turn into new innovations and new industries.

In fact, the key to understanding America’s historic ability to respond to great economic crises lies in what economic geographers call the “spatial fix”—the creation of new development patterns, new ways of living and working, and new economic landscapes that simultaneously expand space and intensify our use of it. Our rebound after the panic of 1873 and long downturn was forged by the transition from an agricultural nation to an urban-industrial one organized around great cities. Our recovery from the Great Depression saw the rise of massive metropolitan complexes of cities and suburbs, which again intensified and expanded our use of space. Renewed prosperity hinges on the rise of yet another even more massive and more intensive geographic pattern—the mega-region. These new geographic entities are larger than the sum of their parts; they not only produce but consume, spurring further demand.

§

Infrastructure is key to powering spatial fixes. The railroads and streetcar, cable car, and subway systems speeded the movement of people, goods, and ideas in the late 19th century; the development of a massive auto-dependent highway system powered growth after the Great Depression and World War II. It’s now time to invest in infrastructure that can undergird another round of growth and development. Part of that is surely a better and faster information highway. But the real fix must extend beyond the cyber-economy to our physical development patterns—the landscape of the real economy.

That means high-speed rail, which is the only infrastructure fix that promises to speed the velocity of moving people, goods, and ideas while also expanding and intensifying our development patterns. If the government is truly looking for a shovel-ready infrastructure project to invest in that will create short-term jobs across the country while laying a foundation for lasting prosperity, high-speed rail works perfectly. It is central to the redevelopment of cities and the growth of mega-regions and will do more than anything to wean us from our dependency on cars. High-speed rail may be our best hope for revitalizing the once-great industrial cities of the Great Lakes. By connecting declining places to thriving ones—Milwaukee and Detroit to Chicago, Buffalo to Toronto—it will greatly expand the economic options and opportunities available to their residents. And by providing the connective fibers within and between America’s emerging mega-regions, it will allow them to function as truly integrated economic units.

Obama allocated $8 billion towards high speed rail in his 2009 budget. It’s a start, but a disappointingly modest one. Depending on who’s doing the estimating and how high speed a system is envisioned, the price tag for a fully modern, truly national high-speed rail system runs somewhere between $140 and $500 billion. That’s a lot of money, but measured in 2009 dollars, Eisenhower’s Interstate Highway System cost $429 billion to build—which makes it look like something of a bargain.

High speed rail is just one solution—we will need many more if we are going to encourage our cities to become more densely developed, more innovative, and more economically vibrant. But we won’t find solutions if our pundits, politicians, and business leaders are still caught up in parochial arguments about debt and deficits, and how to bring back the housing industry. We can’t neglect the present, but we also have to think beyond it. If we keep spending on the old economy and our old ways of consumption and living, a new, post-industrial society may still emerge, but it will take longer to do so and it may not be one that most Americans will want to live in.

Richard Florida is the director of the Martin Prosperity Institute at the University of Toronto’s Rotman School of Management, and the author of The Great Reset (Harper Collins) and The Rise of the Creative Class (Basic Books)