INSIDE TUCSON BUSINESS

November 5, 2010

Although leasing and sales activity in the office sector has been mostly consistent through the first three quarters of 2010, market watchers aren’t ready to declare that a sustainable recovery is underway. PICOR Commercial Real Estate Services, for one, is hedging on that. Because the effects of the Great Recession are still playing out, it’s too early to tell with certainty which way the category is headed.

“The recent consistency we have seen is positive, however, it is unclear whether this is a sign of more activity to come or simply where the market is going to stay for some time,” said Rick Kleiner, principal and office specialist at Picor. “Note that there has been some modest growth in inventory. That is good news, good that the increase in vacancy is not a larger number.”

Because financing is still difficult to secure, there were very few sales during the third quarter. The most significant transaction was the $8.65 million purchase of a 34,000 square foot medical office building by Northwest Hospital. The property, at 6080 N. LaCholla Blvd., was sold by Desert Cardiology.

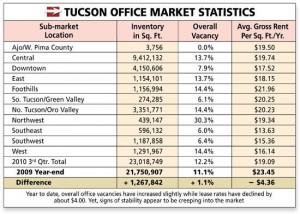

The region’s central submarket, basically the area around Williams Centre at East Broadway and Craycroft Road, had the largest available inventory at 9.4 million square feet. Inventory was smallest in the south/Green Valley at just over 274,000 square feet. All 3,756 square feet of space in the Ajo/ west Pima County submarket was leased.

Overall, there was 23 million square feet of office space on the market. At year-end 2009, the total was 21.75 million square feet, or 5.8 percent less.

For vacancies, the northwest sector had the highest rate at 30.3 percent. The lowest was the southeast sector at 6 percent. The 2010 third quarter finished at 12.2 percent vacancy compared to 11.1 percent at the end of 2009.

Since then, average gross rental rates have dropped $4.36 and Kleiner sees a further decline.

“It is such a tenant’s market, landlords are motivated to reduce rates to keep a tenant or secure a new tenant. There are a couple of ways they’re doing this, with attractive rates, concessions, and generous tenant improvement allowances,” Kleiner said.

There are businesses that are taking advantage of market conditions to improve their locations or move into nicer buildings for the same or less money than they are currently paying. Kleiner said opportunists are moving up from Class C to Class B space; with Class B tenants likewise grabbing Class A space.

“It will be a tenant’s market for another 12 months, or at least until the air of uncertainty clears,” he said.

Foreclosure dip

During the third quarter, 4,623 homeowners in the city of Tucson received notices of foreclosure. That is a 7.6 percent decrease compared to both the second quarter 2010 and the year-ago 2009 third quarter.

The data was compiled by RealtyTrac, an online database of foreclosed properties, in its third quarter 2010 Metropolitan Foreclosure Report.

Overall, Tucson posted the nation’s 41st-highest rate of foreclosure, with one in every 92 housing units receiving a notice.

The states of Arizona, Nevada, California and Florida accounted for 19 of the top 20 metro foreclosure rates. Boise, Idaho, at No. 14, was the only other metro area in the top 20.

“The underlying problems causing homeowners to miss mortgage payments – high unemployment, toxic loans and negative equity – are continuing to plague most local housing markets,” said James Saccacio, chief executive officer of RealtyTrac.

Las Vegas posted the nation’s highest foreclosure rate with one in every 25 homes receiving a notice. That is more than five times the national average. Fort Myers-Cape Coral, Fla., was second highest with one in every 35 houses (2.84 percent) receiving a filing.

Phoenix-Mesa-Scottsdale posted the eighth highest ratio where one in every 44 housing units received a notice.

http://azbiz.com/articles/2010/11/08/construction_real_estate/doc4cd4441158f75383579139.txt